What Are Turnkey Auctions?

How they benefit both the buyer and the seller

Turnkey auctions offer a wide variety of benefits for both buyers and sellers! They bring in competitive bids for sellers and are incredibly easy way to buy or sell a whole company. Turnkey auctions are one of Miedema Asset Management Group’s specialties, and we put a lot of time and effort into these sales. Because turnkey auctions are different from the other auctions that our sister companies offer (online, live, multi-parcel etc.) we wanted to break down what exactly a turnkey auction is and the benefits that they provide buyers and sellers.

What Are Turnkey Auctions?

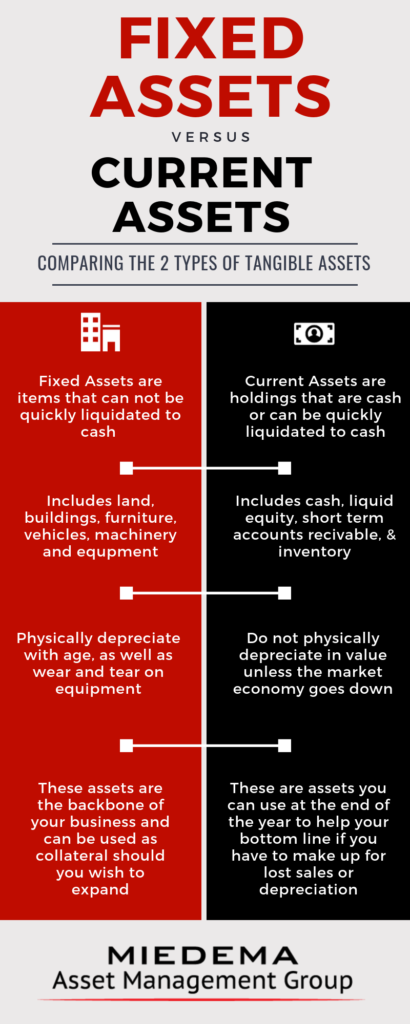

A turnkey auction is a complete sale of all company assets. This includes all real estate, equipment, inventory, the Goodwill/Book of business and any other assets. The buyer would essentially be able to turn the key in the lock and start running a fully operational business (hence the name turnkey).

Any turnkey auctions that come through Miedema Asset Management Group will likely be sold through a sealed bid process. Interested parties will submit one bid stating the amount that they are willing to pay for the entirety of the turnkey property. Then, after the submission deadline the bidder with the highest offer will win the property. Bidders will not have the opportunity to see what the other parties offered, nor will they be able to place a counterbid. In this manner, turnkey auctions are essentially a direct sale with a secrete competitive twist (which is why you can find theses auctions on the direct sales tab of our home page). Sealed bidding is a good way to make sure that only serious buyers participate in the auction and encourages them to make offers that reflect the true value of the turnkey property.

Benefits for Buyers

Turnkey auctions are fantastic for buyers because after the sale closes, they have a fully functioning company ready to go. They won’t have to worry about the process of setting up an office, factory, or machine shop. Transporting equipment to a new building won’t be an issue – it will be there already! If an individual is looking for an extremely easy way to start their own business in a specific industry, a turnkey auction is a great way to do just that. Turnkey auctions are especially beneficial for a company that is looking to expand their current operations. A company that is already operating will have a management strategy in place, a game plan to move forward, and industry knowledge that will allow them to take on a new location without major complications.

Benefits for Sellers

A company that has decided to close its doors has a lot to decide when it comes to how the assets will be liquidated. One of the easiest ways to quickly liquidate all property is through a turnkey auction. The seller won’t have to worry about advertising different assets to a variety of industries – they can sell everything to one buyer. They also won’t have to negotiating prices with buyers, or even interact with potential buyers at all! Plus, a company would get the added bonus of receiving cash for any intangible assets. It’s hard to liquidate company reputation for cash the way that a seller would liquidate equipment. Turnkey auctions also allow a company to recognize gain from their intangible assets that otherwise wouldn’t have a concrete monetary value.

All in all, turnkey auctions are a great way to buy and sell property. The ease of the process is fantastic from the perspective of both the buyer and the seller, along with the other benefits that we touched on. If you are interested in selling your company with Miedema Asset Management, contact us today. If you’re looking for your next investment, click the button bellow to check out our upcoming turnkey and other sealed bid auctions.